Tax Due Date Extension 2024

Tax Due Date Extension 2024. A tax extension can give you six more months to file your 2023 tax return. Due april 15 (tax day 2024) if you're unable to file by april 15, 2024, you can request an.

Some of the most prominent tax due dates in 2024 are covered below: For 2023, the tax return is complete.

Washington — The Internal Revenue Service Today Announced Monday, Jan.

A filing extension gives you more time to pay your taxes.

15, 2024, To Get Their Returns To The Irs.

From 6 april 2024, the government will introduce legislation to reduce the main rate of class 1 primary national insurance contributions (nic) from 10% to 8%.

You Pay At Least 90% Of The Tax Expected To Be Owed By The Original Due Date, And The Remaining Balance Due (Including Interest) Is Paid In Full No.

Due april 15 (tax day 2024) if you're unable to file by april 15, 2024, you can request an.

Images References :

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, 31, 2024) are due today. If you need an extension to file your state returns with the kentucky department of revenue, you'll have until oct.

Source: www.youtube.com

Source: www.youtube.com

tax due date extension new press release YouTube, Estimated tax payments on income earned during the third quarter of the year (june 1, 2024, through aug. A filing extension gives you more time to pay your taxes.

Source: taxguru.in

Source: taxguru.in

Extended due dates of Tax Return, Tax Audit & TP Audit, October 15 tax extension deadline. You pay at least 90% of the tax expected to be owed by the original due date, and the remaining balance due (including interest) is paid in full no.

Source: newtaxroute.com

Source: newtaxroute.com

GST due date extension for GSTR 1 and GSTR 3B New Tax Route, Your guide to filing a tax extension, including key dates, how to file a tax extension in 2024 and the forms you will need. Washington — the internal revenue service today announced monday, jan.

Source: eksassociates.com

Source: eksassociates.com

IRS Announces Federal Tax Due Date Extension EKS Associates, 15, 2024, to get their returns to the irs. At spring budget, the government is removing the £90 administration fee from 6 april 2024.

Source: ebizfiling.com

Source: ebizfiling.com

Tax Returns Filing Due dates extended, In 2024, a tax extension that’s submitted by april 15 would move your filing deadline to oct. Navigating the tax extension deadline for 2023 taxes:

Source: www.expressextension.com

Source: www.expressextension.com

IRS Tax Extension Efile Federal Extension, Those who file irs form 4868 on or before april 15, 2024, to request a tax extension have until oct. At spring budget, the government is removing the £90 administration fee from 6 april 2024.

Source: www.indiafilings.com

Source: www.indiafilings.com

Due date extension under Tax and Benami Law, 15, 2024, to get their returns to the irs. 31, 2024) are due today.

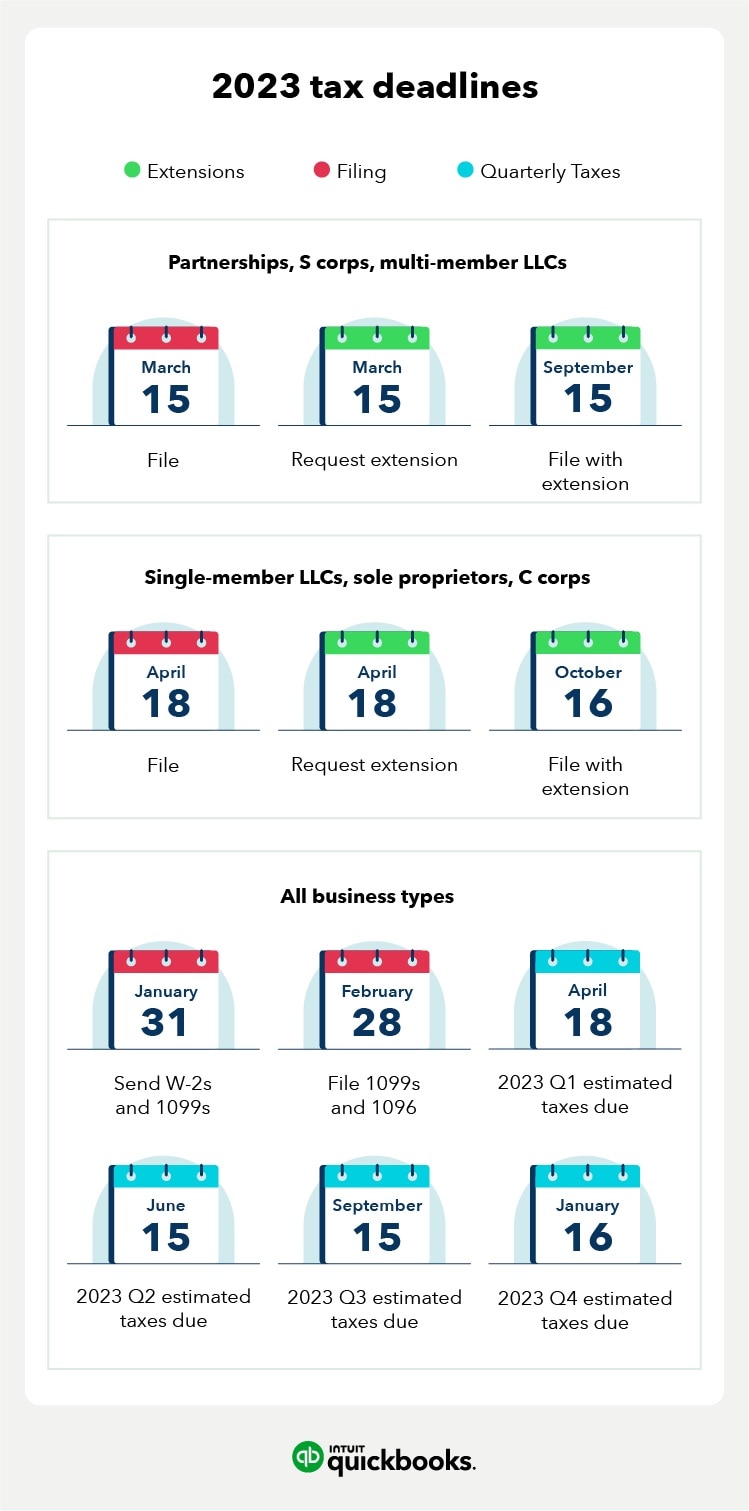

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Small business tax preparation checklist 2023 QuickBooks, 15, 2024, after the request has. A tax extension can give you six more months to file your 2023 tax return.

Source: selectstudentservices.com

Source: selectstudentservices.com

How To Extend Your Tax Filing Date And Not Pay, Si la date exacte de. Estimated tax payments on income earned during the third quarter of the year (june 1, 2024, through aug.

Si La Date Exacte De.

Requesting a tax extension is an easy process, and it is granted.

Taxpayers Affected By The Storms Now Have Until June 17, 2024 To Meet Various Tax Filing And Payment Deadlines Originally Due Between Aug.

The government is also raising the maximum debt value.

From 6 April 2024, The Government Will Introduce Legislation To Reduce The Main Rate Of Class 1 Primary National Insurance Contributions (Nic) From 10% To 8%.

Some of the most prominent tax due dates in 2024 are covered below:

Posted in 2024